Credit unions processed approximately €200m in new mortgage lending in 2023. As a result of the legislative changes which came into force today, we anticipate this volume doubling each year for the next couple of years. We believe the credit union mortgage lending could reach €1bn per annum within 3 to 4 years which could put credit unions in the top 5 mortgage lenders.

For the first time, credit unions can now offer a service or product such as a home loan to a member of another credit union – under a formal arrangement with that other credit union. For householders and aspiring homeowners, this means there will be greater access to fairer mortgages as credit unions will be able to refer mortgage applications to other credit unions should they not be in a position to provide a mortgage themselves. This effectively means that every credit union in the country will be able to offer mortgages.

Credit unions can also refer applications for other products to another credit union – such as current accounts, debit cards, and business loans. Credit unions can now essentially partner with other credit unions to offer their members a wider selection of products.

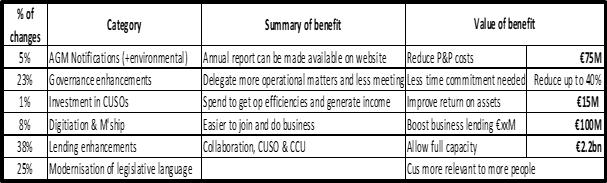

This new collaboration on lending could generate an additional €2.2bn in lending each year for credit unions.

Credit union members will have more access to digital and automated services as a result of the enhancements to the Credit Union Act. This increased digitalisation will generate cost savings for credit unions in a number of areas. For example, the ability to make credit union annual reports available online will save credit unions an estimated €75m a year in postage and printing costs (see Appendix). All of these cost savings will then be used to deliver even better and lower-cost products to our members.

In addition, increased digitalisation will make it easier for credit unions to sign up new business members, and lend to these businesses– in this regard, we estimate that digitalisation will boost business lending alone by €100m a year.

The changes that come into force today (February 21, 2024) are just the first of a suite of enhancements to the Credit Union Act in the pipeline. Other changes in the pipeline are the establishment of credit unions for credit unions (aka Corporate Credit Unions) and the ability of credit unions to invest in shared services – these will help credit unions provide maximum efficiency for their members by sharing costs and expertise. This in turn will enable credit unions to offer a wider range of lower-cost loans and other products to their members, as well as more favourable returns on savings.

ENDS

Appendix