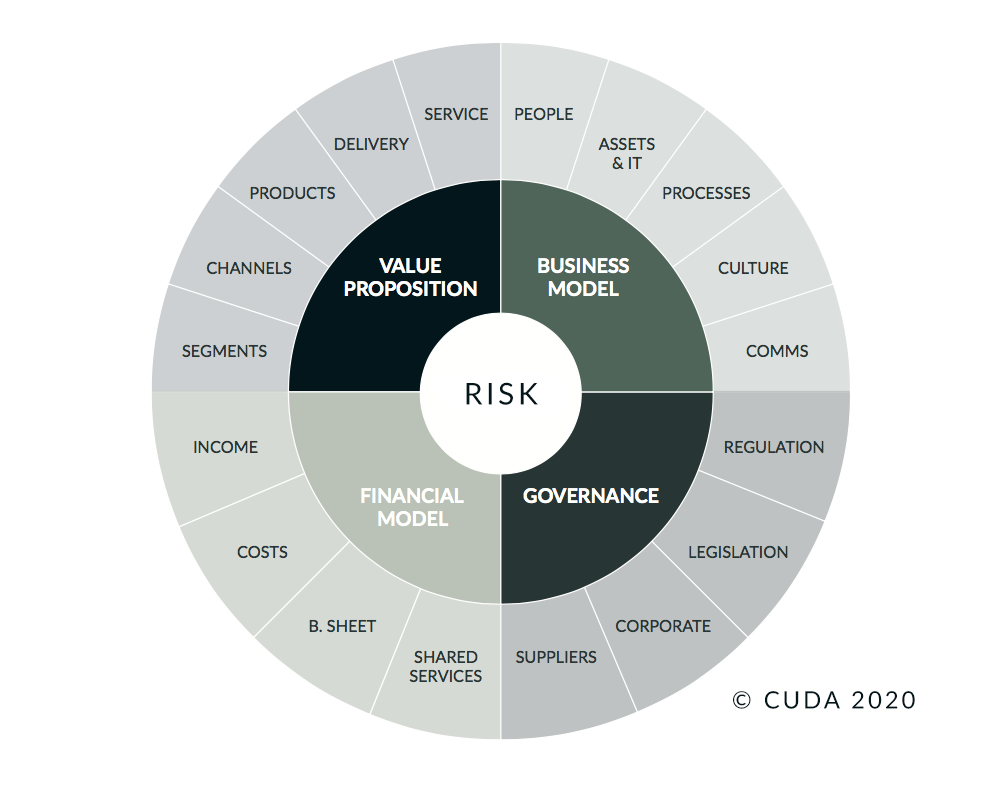

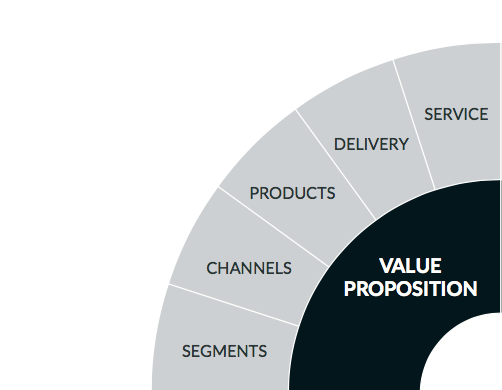

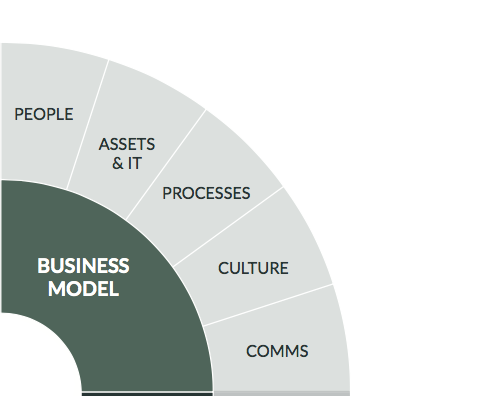

The Model CU differentiates based on its unique ethos and utilises a relationship-based approach to actively support member decision making via well-trained advisors.

It proactively targets the most profitable segments and member needs using a data-driven approach and delivers frictionless, personalised experiences on the channel members prefer.

A balanced product portfolio is led by lending as this is most profitable. Products are based on validated member needs and deliver true value, helping The Model CU avoid price competition.

24/7/365 member engagement is supported by digital channels, alongside branches for those seeking the personal touch. Preferred partners are utilised to extend market reach.

Members can self-service using digital tools and receive fast and effective responses to all other queries.