CUDA supported credit unions on track to provide €150m of new mortgage offers this year – the credit union sector will exceed €250m

- Average mortgage amount is €185,400

- Average interest rate is 3.72%

- Credit union mortgage lending should reach €1bn per annum by 2027

Credit unions on CUDA’s Mortgage Support Platform, SAM which the majority of mortgage approvals in the credit union sector, are on track to provide €150m or more of mortgage offers this financial year with the – a remarkable 18-fold increase in mortgage activity in just six years.

Total mortgage lending on the platform – a framework which allows credit unions to offer residential mortgages – already exceeded €70m in the first half of the current financial year for credit unions which commenced on the 1st Oct and will easily exceed €150m for the full year. This is up from €8.1m in 2018. An incredibly strong performance according to the platform’s half yearly results[1], which have just been published.

Other highlights of the results show that:

- The average mortgage amount has almost doubled since 2018, increasing from €108,835 in 2018 to €185,474 in 2023 on an average property value of €341,700

- The average mortgage term has increased from 18 years in 2018 to 23 years in 2023

- Average interest rate is 3.72%

35% of borrowers are individuals with the remaining 65% couples

The SAM mortgage platform is a wholly credit union owned service which supports credit unions in achieving significant levels of mortgage lending. Currently, more than 25 credit unions are now providing mortgages through the platform and this is constantly growing.

Commenting on the new figures, Kevin Johnson, CEO of CUDA said:

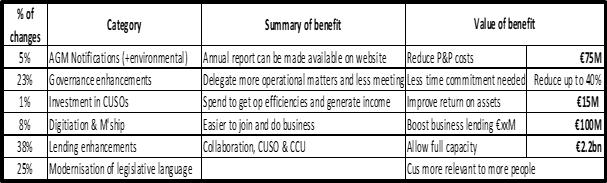

“The phenomenal growth in lending is driven by an increased appetite for credit union mortgages as well as the increased ability of credit unions to provide mortgages. The demand from Members is clear, they want an alternative to the banks and Credit Unions are stepping up. For several years now Regulators have encouraged credit unions to grow their lending and it is testament to the dedication of credit unions to upskill and bring much needed competition to the market. As the figures show they are doing this in a prudent manner and growth in loans is reflective of their growth in capability. Legislators have also encouraged credit unions to increase their lending and arising from the legislative changes signed last February, in the last quarter of this year credit unions will be permitted to offer a service or product such as a home loan to a member of another credit union – under a formal arrangement with that other credit union. This effectively means that every credit union in the Country will be able to offer mortgages.

Experienced credit unions in this space are evolving from niche players to full participants in the mortgage market. Today’s figures are indicative of the evolving confidence and risk appetite of credit unions as they gain more experience in providing mortgages.

The numbers reflect this very fluid and developing market for Credit Unions. The last financial year was the first full year in which SAM credit unions have offered fixed rate mortgages, and they have quickly taken root representing almost one quarter of total mortgage lending on the platform. And though green mortgages accounted for 6.5pc of total mortgage offers, this product is only emerging and currently only available from three credit unions on the platform, for those credit unions green mortgages account for 35% of their total mortgage lending”.

CUDA contend that as a result of the new legislative changes, we believe that total new credit union mortgage lending could reach €1bn per annum by 2027 which could put credit unions in the top five mortgage lenders.

Mr. Johnson concluded,

“There is already strong demand for credit union mortgages. With the support of CUDA’s Mortgage Platform, with more supports coming available in the near future and indeed even with every credit union in the country effectively being able to offer mortgages, we hope this will encourage the Central Bank of Ireland to extend the boundaries and facilitate credit unions provide even more home loans. Credit unions are trusted by consumers – in 2023, they topped the table for the best customer experience (the CX Customer Experience report) in Ireland for nine years running. Furthermore, credit union lending rates are particularly competitive as they are not impacted by elevated ECB rates. While the banks hold the lion’s share of mortgage lending in Ireland, with total mortgage lending for the banking sector reaching almost €11.4bn in 2022, credit unions have become and will continue to be a strong contender in the Irish mortgage market and are on track to win more of this mortgage pie from the banks in the coming years.”

ENDS

Notes to editor

SAM

SAM (System for Application Management) is a best practice framework for credit unions to offer consumer mortgages. As a wholly credit union owned service, the purpose of SAM remains to support credit unions in achieving significant levels of mortgage lending, delivered at a price point that will not erode their financial performance on a low margin product line.

SAM provides credit unions with optimised processes from application to assessment, documentation and a workflow management system that ensures a consistent approach and compliance with ESIS, MARP and other requirements.

SAM includes training and service support, access to CUDA’s legal and compliance services, and the option for external file assessment by an industry expert at discount rates.

Excellent member experience is ensured via streamlined processes, competitive rates and the personal approach which has made credit unions the most trusted brand in Ireland for many years running.

SAM was originally launched in 2017 and was upgraded in 2021. For more details, visit www.solutioncentre.ie.

[1] For the months Oct 1, 2023 to March 31, 2024